Sometimes taking loans may be a tough task because of poor credit scores, it is not a mystery that people with low credit scores have a hard time finding a lender who is ready to accept their loan application. Even though there are short term loans available for people with poor credit, like payday loans, £500 loans and many more, these are just small loans.

Lenders run soft or hard eligibility checks on their applicant’s credit history when he applies for a loan with them.

As people are aware that there are ways to check your credit score without having it affected, that is by using a loan eligibility checker, it will help you determine your eligibility for a loan. Even for you to use the loan eligibility checker, there are certain requirements you have to meet.

If you want to know how to improve credit score UK, then read on further to know more.

What is a Credit Score?

It is a calculated numerical result of statistics that helps a lender determine if you’re eligible for a loan. It is used by lenders to determine if you will pay the borrowed sum or not. Credit scores usually range from 300 to 850. Higher scores point out the punctuality of payments and the trustworthiness of the borrower. The Fair Isaac Corporation (FICO) created the credit model and now is widely used by financial institutions and corporations alike. FICO credit scoring system is by far one of the most popularly used systems.

Here below is the average FICO score range

- 300 – 579: Poor

- 580 – 669: Fair

- 670 – 739: Good

- 740 – 799: Very Good

- 800 – 850 Excellent

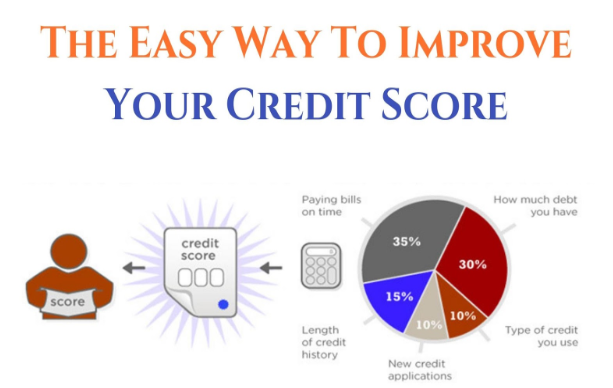

Factors That Affect Credit Scores

Here are some of the common factors that affect your credit scores:

- Newly taken credit

- The type of credit

- Credit history length

- The total amount that you owe

- Payment history

Credit Checks

When a financial institution searches for information regarding your credit history, it is called a credit check or credit search. This is done in order to determine your financial behavior, like making payments on time and many more. This is crucial for a lender as it is up to him to decide if you’re eligible for the loan or not. There are two types of searches that lenders usually do:

Soft Search

This is where the lender looks for information on your credit history without recording it in the search. This ensures that your credit score will not be further affected. Because of this feature, it is a widely preferred method of search for the borrower as some may have low credit scores and may not know about how to improve credit scores UK.

Hard Seach

If you don’t know if you have a good credit score or if you don’t know how to improve credit score UK, then hard credit searches for you is a hard no. this is because hard searches are searches where the lender reviews and check your credit history extenk1pZ6PvlH2QTPFSY2iOFjsively in order to determine your eligibility for a loan. Hard searches also affect your credit score and lower them if you don’t have a good credit history.

Ways to Improve your Credit Score

The process of improving credit score can sometimes be pretty long and it is important to remember that the results are always worth the effort. Also, poor credit scores can be unhelpful to anyone who is in need of money, but this is not a problem that is uncommon amongst people. Luckily, there are ways to improve your credit score, the time span through may depend on how much you are willing to work towards improving it.

Listed below are a few answers to the frequently asked question “how to improve credit score UK?”

Reviewing Your Credit Reports

Something that people know very less is that you are eligible to take out credit reports for free from three major credit bureaus which are Experian, Equifax, and TransUnion. Also, you are only eligible to do that once a year. Reviewing these scores will help you determine the reason for your poor credit scores. This is the very first step to improving your credit scores.

Making Payments Frequently

Knowing how to improve credit score UK is very important and making micro-payments (small payments) throughout the month is vital as it helps in keeping your credit balance low. Doing this basically also works on a factor known as credit utilization and this has a huge effect in increasing your credit scores.

Getting Higher Credit Limits

Your balance will stay the same when your credit limit goes up and that tends to lower the credit utilization, overall. Calling the respective card company and asking if you can get a higher limit card with a soft credit check can cause the score to points to drop by a few, temporarily.

Score-Boosting Programs

There are programs that help customers by boosting a thin credit profile, with other finance-related information. UltraFICO and Experian Boost are two such programs. For example, when you opt in to Experian Boost lets you add utility payments and telecommunications history to the report. Whereas, UltraFICO considers savings and checking account data by allowing you to give permission for banking data to be considered.

Conclusion

These are a few tips on how to improve credit score UK. Also, there are many more things that one can do to improve their credit score. It is a wise thing to constantly improve your credit scores, as it may help you in the future when you’re in need of finances.