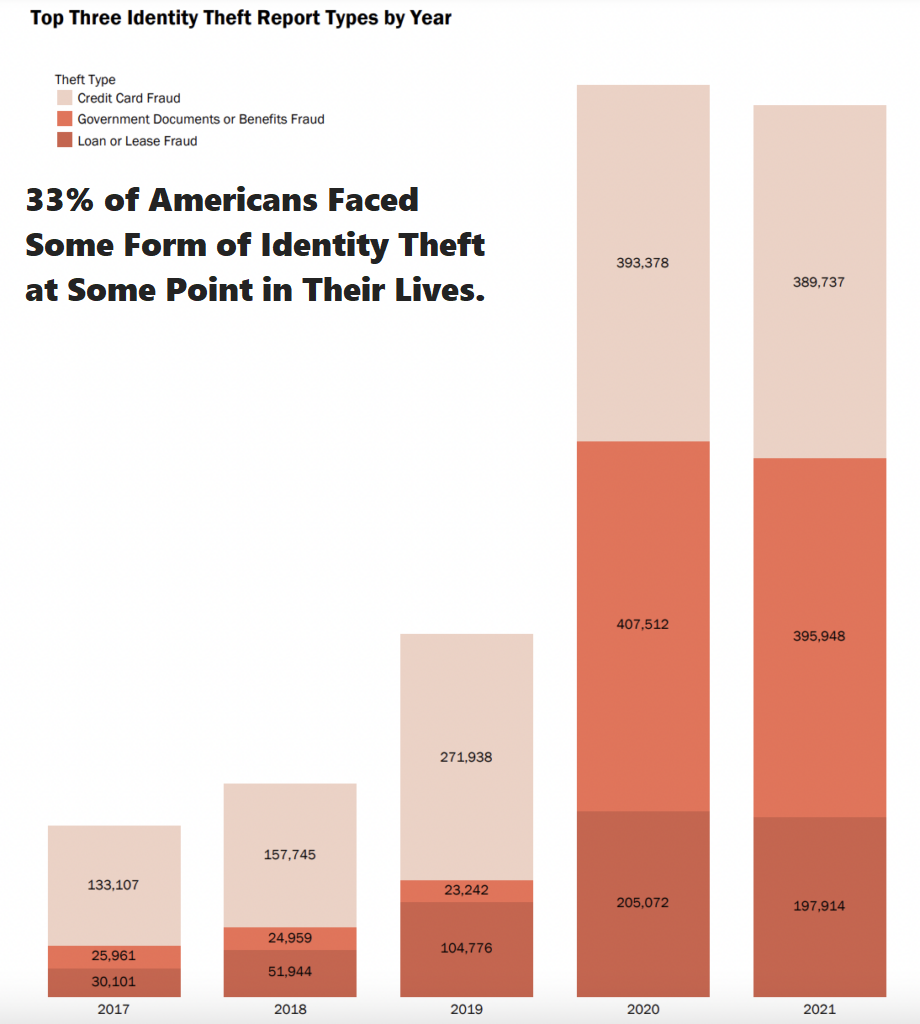

Is your identity safe from theft? You shouldn’t assume that it is. Thirty-three percent of Americans have already been the victims of identity theft. If your information was involved in a data breach, you’re at an increased risk of identity theft. If you’ve already had your identity stolen, you already know how hard it is to clean up the aftermath of identity theft.

Fortunately, there’s identity protection. While you may be able to monitor your own credit card and bank statements and credit report for signs that your identity has been stolen, most identity protection services can go beyond what you’re able to do on their own. Identity theft protection plans also usually come with insurance that can help you recover legal fees and even lost funds.

What is Identity Theft Protection?

Identity protection services help lower the risk of having your identity stolen. They might not be able to prevent every instance of identity theft, but they can prevent most of them, and they can help you recover if you do fall victim to this form of theft. They hire teams of professionals who can monitor the dark web, social media, public records, your credit file, and more for signs that your identity has been stolen or your personal information compromised.

They can make you aware, for example, if your personal information, like your Social Security number and birthdate, appear on the dark web, where criminals often go to buy stolen information. They can also help you place a freeze on your credit and manage your logins with a password manager so you can use complex and unique passwords for every one of your accounts. They can monitor social media platforms for fraudulent profiles under your name or other questionable appearances of your personal information or photos. Some identity protection services can even scrub your personal data from data-broker sites, to help keep it private.

How Identity Theft Protection Works?

It is important to take steps to protect yourself from identity theft. One way you can do this is by investing in identity theft protection services. These services provide monitoring, alerts, resolution assistance and even insurance coverage in the event of a breach or fraud incident involving your identity.

-

Monitoring

Identity theft protection companies monitor activity related to your personal information such as credit card accounts, bank accounts and social security numbers for suspicious activity like new account openings or large purchases made with existing cards without authorization from you first. If any unusual activity is detected then an alert will be sent out so that you are aware of what has happened right away before any major damage occurs due to the fraudster’s actions.

-

Alerts

When suspicious or unauthorized activities occur on monitored accounts associated with your name/personal data then an alert will be sent notifying you about this issue immediately via text message/email etc. It is allowing quick action on stopping further misuse if necessary (such as cancelling credit cards). This helps reduce the amount of time needed for resolving issues caused by ID thieves since they are caught early instead of after much harm has been done already.

-

Resolution Assistance

Many times when someone’s identity has been stolen they may need help dealing with all the paperwork involved in getting things back under control again (e.g.: filing police reports; contacting banks; disputing charges etc.). Identity Theft Protection Services offer Resolution Assistance which provides access to professional advisors who specialize in helping victims resolve these types of issues quickly & efficiently while minimizing stress levels throughout the process too!

-

Insurance Coverage

Insurance Coverage covers costs incurred during the recovery process such as lost wages & legal fees if applicable depending upon policy chosen at sign-up stage itself. This helps ensure financial losses do not become too great while trying to reclaim one’s good name back after being victimized by criminals using their private details illegally online / offline world alike!

Who Needs Identity Theft Protection?

If you’ve been involved in a data breach, then you definitely need to buy identity theft protection services – while criminals won’t end up using all of the personal information stolen in a large data breach, you’re still at an increased risk of identity theft and cyber attack. If you’ve already been the victim of identity theft once, you’re more likely to be again, so you should buy identity protection services.

You also definitely need identity theft protection if you’re unwilling or unable to at least monitor your credit file, bank accounts, and credit card accounts for unauthorized activity. If you can’t or don’t want to freeze your credit, you should get identity theft protection until such time as you’re ready to freeze your credit.

Identity theft protection services typically identify issues with your identity quickly, so unless you’re very vigilant about monitoring your credit file and accounts, you run the risk of having your identity stolen and not finding out about it for weeks or months, by which time there’s quite a lot more damage to clean up. Of course, identity theft doesn’t just cause financial damage – thieves can commit other crimes under your name, for example, resulting in you getting arrested for something you didn’t do. Thieves could even steal your health benefits or your tax refund.

With identity theft protection, things don’t have to get that far – and if they do, you’ll have help dealing with it. Most identity protection plans include recovery assistance from an actual human being, who can walk you through the process of getting your identity back. You may also get some insurance coverage to cover legal fees at minimum, and perhaps even lost wages and stolen funds.

Do You Already Have Identity Theft Protection?

Some people already have identity theft protection, or access to it. If you’ve been involved in a data breach, you’ve probably been offered free credit monitoring in the aftermath. You may already have identity theft protection through your bank or credit union or through one of your credit card issuers. Some organizations, like the AARP or AAA, offer free credit monitoring to their members. You may also get it through your homeowners insurance or through your benefits plan at work.

If you’re alive in 2023, you need some form of identity protection. Identity theft is getting more and more common – even children aren’t safe, and you can’t possibly monitor all the things you need to monitor to protect yourself. With identity protection, you’ll be able to avoid most attempts at identity theft and you’ll be ready to handle it if it does happen.

Conclusion

All in all, investing into Identity Theft Protection Service is great way safeguard oneself against potential harm caused by malicious individuals trying access important data belonging others – ensuring both peace mind & financial safety no matter what circumstances might present themselves later down road!