A certificate of insurance might be requested for projects with big liability concerns or a risk of huge financial losses. In these cases, the client will ask for a certificate of insurance from your business to get proof that specific liabilities are included with your insurance cover. Getting a COI offers more protection to both your business and your clients and gives both parties peace of mind prior to working together.

What is a Certificate of Insurance (COI)?

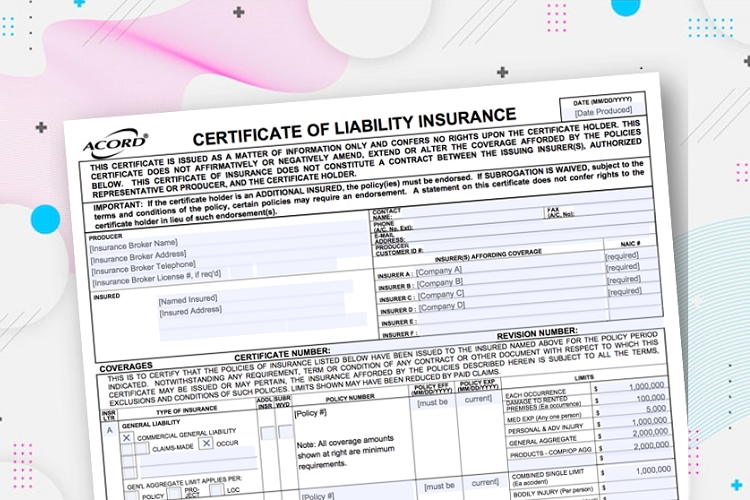

A certificate of insurance is a way to summarize the most important aspects of your company’s insurance policy. It should include essential information regarding your insurance policy, such as the effective and expiration dates of the policy, who it covers, the coverage type that it offers, and the limits.

Having a COI allows companies to provide proof of insurance to partners or clients easily. Instead of being required to send them your insurance policy documents in full to prove that you are covered, you can send a brief document that details the essentials. You can find out more about a certificate in insurance at The Hartford. If you need a certificate in insurance, get your business quote and start a new policy online.

Why Get a COI?

A certificate of insurance is important for your company and any customers, clients, or partners that you are working with. When your business is insured, the ability to show quick proof of that insurance can help your business take on new clients, find new partners, and expand the business.

These days, not many people or businesses will be eager to work with companies that are not insured. Because of this, if you’re submitting bids to win jobs or contracts, you will usually need to include a certificate of insurance with the bid in order to be considered.

Who Should Get a COI?

Whether or not you should get a COI will depend on your company’s role when it comes to working with clients or other businesses. For example, suppose you’re running a restaurant and working with a food product supplier.

In that case, you’ll want to make sure that they are insured should anything be wrong with the products they supply. If they’re not, then your insurance will need to cover all the costs that might be associated with that.

How to Get a COI

Before you get a COI, it’s good to make sure that your insurance policy meets the requirements. This way, you will be able to make adjustments as needed to your insurance before you send the proof. You can usually get a COI directly from your insurance company or ask a broker to get it on your behalf. You can get a printed or electronic COI to send to your client or partner.

If you’re working with clients or partnering with another business, they will usually want to see that you are insured. A COI is a simple way to prove to anybody that you work with that you have an adequate level of insurance for the job.