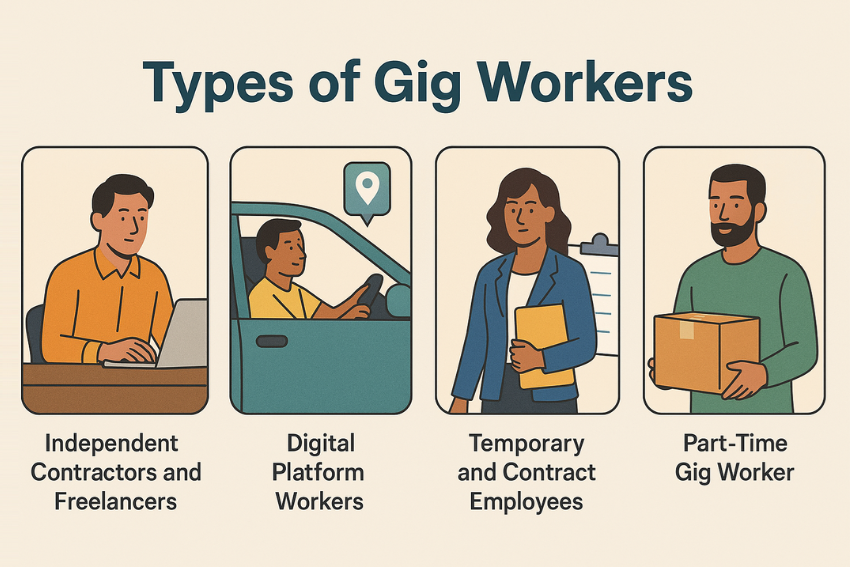

The world of temporary, flexible labor includes many types of gig workers, encompassing a broad spectrum of roles, skill sets, and working arrangements. These are free-market professionals that operate the modern economy and find ways of providing services through short-term agreements and online platforms. To study this workforce, it is necessary to divide the individuals into categories according to their relationship in the work, the level of commitment to it, and specialization.

Here is a breakdown of the several types of gig workers today:

Independent Contractors and Freelancers

These employees are the archetypal meaning of the gig economy. They have their own small business, where they provide specialized services to various customers or companies.

- Specialized Consultants: These are professionals who have expertise at the highest level of skills in such areas as software development, marketing strategy, data analysis, or financial consulting. They tend to be premium and are undertaking high-value long term projects.

- Creative Professionals: This is a group where writers, graphic designers, photographers, video editors, and content creators fall. They normally seek online or direct client relationships in acquiring project-based work.

- Knowledge Workers: These are professionals such as translators, virtual assistants, legal reviewers and technical writers who apply their intellectual capabilities to accomplish complicated tasks by being remotely connected.

- Control and Autonomy: Independent contractors determine their schedules, approaches, and mechanisms on their own. They have a high level of professional freedom going about their self-taxation and benefits.

Digital Platform Workers (Platform Gig Workers)

This segment relies on smartphone applications and internet websites as the main source of identifying, accepting, and undertaking short-term jobs.

- Rideshare and Delivery Drivers: This is the most apparent category, and these employees operate with apps, such as Uber, Lyft, DoorDash, and Uber Eats. Their activities tend to be based on certain local activities which need the presence and also the real-time coordination.

- Task-Based Service Providers: This group includes people that provide local services via apps like assembling furniture, house repair or cleaning, or dog walking.

- Microtask Workers: These gig workers complete small, repetitive digital tasks for low pay, often involving data entry, content tagging, or image verification, usually sourced through large online labor pools.

Temporary and Contract Employees

Though technically short time commitment is involved in these types of roles, it is not pure independent contracting since it is usually done under scrutiny of a company, often via an agency.

- Agency Temps: A contracted worker who comes under an agency and signs the contracts with another company to provide his or her labor to them over a certain period. The staffing agency provides some benefits to them, but their placement is temporary.

- Seasonal Workers: These are individuals recruited by an organization to work temporarily to handle demand during the off-peak season, including retail employees in the holidays or tax preparers in the filing season.

- Contract-to-Hire: Employees are hired at the beginning on a temporary basis on a contract basis with the expectation that when they have performed well, the company may offer them a permanent and full-time position.

Part-Time Gig Workers (Side Hustlers)

These people also have a full-time job and use the gig economy as a way to enhance their main income source and consider it as the second source of income and not a full-time job.

- Moonlighters: This group of people are those who have a more conservative full-time job and, in the evening or on weekends, do some gig jobs, like freelance writing or delivering an item, to get some additional income or to pay a debt off.

- Hobbyists-Turned-Entrepreneurs: These are people who are selling crafts on Etsy, tutor students online, or are willing to sell individual skills as a secondary income source.

- Students and Retirees: Students and retirees typically seek to use gig work as a means to make money on their schedule or limited retirement budgets, as the ultimate flexibility is important to them.

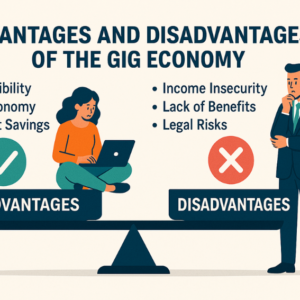

The Defining Factors of Gig Work

Despite the variety, all types of gig workers share several common characteristics that distinguish them from traditional, full-time employees:

- Project-Based Focus: They are based on the accomplishment of certain projects or temporary tasks.

- Variable Income: They have variable incomes depending on how many jobs or clients they can get.

- Non-Employee Status: Most gig workers, especially independent contractors, lack legal protection and guaranteed benefits associated with W-2 employment.

These varied roles guarantee further proliferation into the gig economy, which is going to transform the global labor market ever more.

Frequently Asked Questions (FAQs)

What is the difference between a freelancer and an independent contractor?

They are used interchangeably, but independent contractor is a legal term that is used to refer to a business relationship in which the worker is not an employee. Freelancer is a broader term used to refer to an independent employee that takes up work on behalf of various clients. All freelancers are technically independent contractors both in terms of taxation and law, although the term contractor is commonly associated with an additional degree of specialization or business formality.

Do all gig workers use digital apps?

No. While many gig workers use digital platforms (like rideshare or freelancing websites) to find and manage their work, many specialized freelancers, consultants, and independent contractors find clients through networking, direct referrals, or their own established business websites.

What are the main tax implications for gig workers?

Most gig workers must pay self-employment tax, which covers Social Security and Medicare contributions usually split between employer and employee in traditional jobs. They also have to submit estimated quarterly taxes and income tax is not deductible by any employer in his or her payment.