Whether you are already running a business or just thinking about opening your own during this pandemic, you probably don’t need anyone telling you that now will be the toughest time ever. This doesn’t mean that it isn’t possible. In fact, the right person with the right plan and strategy could come out pretty successful, given all the opportunities that COVID has created in the online sector. While COVID has opened the market for plenty of fruitful opportunities, it has also made some things a bit more difficult. Simply put, you’re going to need to go into the venture with the right financial plan.

What Exactly Is A Budgetary Allocation?

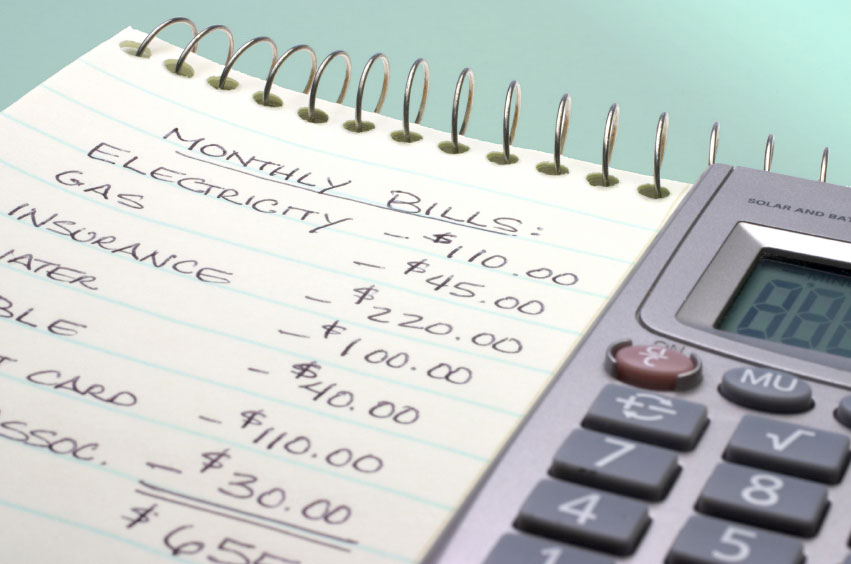

If you’re going to develop a good and sound financial plan, you’re going to need to start with budgetary allocation. The budgetary allocation is a vital part of any annual financial plan, as it indicates the level of resources you are committing to a department or program. If you don’t set limits, expenditures will over exceed revenues and you’ll end up in the red.

This is exactly what a budgetary allocation will let you know. It will let you know how much money you are spending and where you are spending it. Even companies with unlimited financial resources can benefit from these allocations. Given that you’ll likely be on a budget, these allocations will be even more important.

Get Started Before The Month Starts

If you are waiting until March 1st to budget for the month of March you are already behind. This is something that needs to start before you even enter into the month that you are budgeting for. This means that before the month even starts, you should be making a plan and giving every dollar a name and location. Know where every single cent of your budget is going.

This is something that is usually referred to as zero-based budgeting. This doesn’t mean that you have zero dollars in your account. No, it just means that your income minus all your outgoing expenses equal zero. This might not seem like an allocated spending plan to shoot for, but zero-based budgeting means that you aren’t overspending.

Every Month Will Be Different

Unfortunately, every month of your budget will be different. This is where a lot of businesses make mistakes. They set a budget, get comfortable with it, and follow it every month. This will not work because there will be some months where you face unexpected expenses.

For instance, you might have to refresh your inventory in March. You might have to pay outgoing vendors in October. Whatever the situation is, you’ll need to do a budgetary allocation each month.

Cash Limited Budgeting

Cash limited budgeting is another approach that many businesses take. This is a technique that works best when setting a limit on total expenditures. You’ll have to determine what can be delivered within the cash limit and go from there.

The only problem is that this can be a difficult plan to implement when you don’t know the cash limit of the business for the month you are planning. To determine this, you’ll want to identify fixed costs and spread the balance of the budget across items that are not flexible.