Indoor games are the best to create a pleasant atmosphere for any occasion, adults and kids will love these fun activities.Knowing your way around money is essential in today’s world. There are so many things to be aware of and keep track of when it comes to your income, building wealth, savings, and investments. The most basic piece of advice any financially savvy person will give you is to create and stick to a budget. However, so many people skip this important task and worse, have no idea how to begin making a budget.

Creating a budget meant using pen and paper. This was a laborious process that meant that you had to physically record every transaction when you made one. If you have trouble remembering to do this, you are not alone. It’s no surprise that technology has found incredibly useful ways to help out when it comes to keeping track of your money. Today, many people use apps on their phone, tablet, and/or pc to help make their budgets.

10 Best Budgeting Apps to Track Personal Finance

There are many budgeting apps that you can use to help you keep track of your personal finances. However, there are several that are way ahead of the rest. The best budgeting apps not only help you create a budget, but they also help you understand your income and spending, giving you complete control over your money. The following ten budgeting apps are considered the best apps to use.

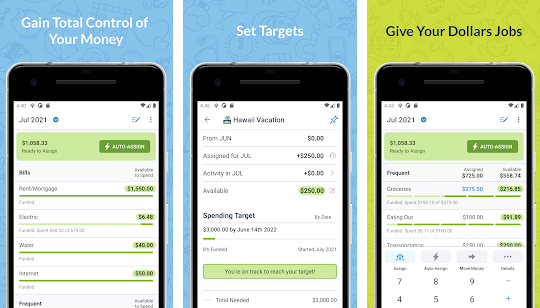

YNAB (You Need A Budget)

This is considered the number one budgeting app of the year by anyone who knows about budgeting and finances. If you are looking for an app that will seriously help you with all things financial, then this is the app for you. YNAB is based around the ‘zero -based’ budgeting system. This means that every dollar you earn must be accounted for and used for something.

This app gives you a 34-day free trial and then it’s either $84 for the year or $11.99/month. Although it is more costly than most apps, it gives you a lot of options for the price. However, the app allows you to sync your bank accounts, import your data from a file, or enter manually.

There are extensive training videos to help new users learn how to navigate the app and plenty of other source to help keep you on your financial goal track.

Users love it because it really makes a difference to your personal finances. New budgeters typically save $600 in their first two months, and over $6,000 in the first year.

|

|

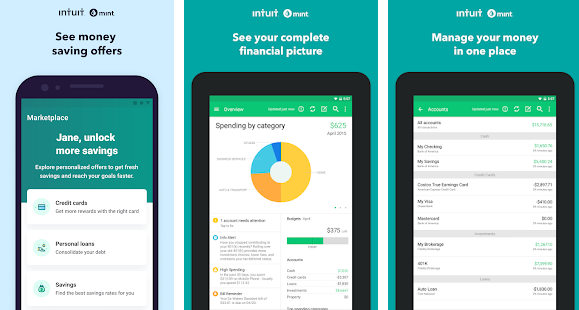

Mint – Personal Finance & Budget

Mint is next on our list due to its ease of use and its users agree that Mint is the best free budgeting app out there. It has over 25 million users and the app is free and easy to use for budgeters of any level. Not only that but you can set up bill reminders, track investments and access your TransUnion credit score.

While the app is free, it does have in-app targeted financial product advertisements, which can be annoying for some users. However, it is offset by the ease of use and the amazing features it offers.

Mint allows you either sync accounts or manually add transactions, as well as see all of your accounts in one place and track your daily spending.

The app also offers a few education resources such as a loan repayment calculator, a home affordability calculator, and a blog with different personal finance topics.

|

|

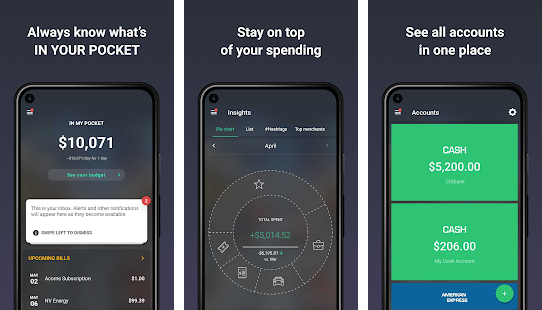

PocketGuard: Track Bills & Budgeting

This is the best app for curbing overspending and helps you take control of your financial goals. This free budgeting app connects your checking, credit, and savings accounts and detects recurring bills and income. The app can then see what you are spending, where to save, and reminds you when your credit card bills are due, so you don’t incur late charges ever again. Their “In My Pocket” feature uses an algorithm to identify how much money you can spend based on your income, upcoming bills, goals, recent spending, and budgets.

|

|

Simplifi – Budget, Finance & Bill Tracker

This app features a personalized spending plan with real-time updates, so you never spend overbudget again. Like Mint and PocketGuard, it syncs your bank accounts to show you where you stand and your progress towards your financial goals. Simplifi also tracks your monthly bills and subscriptions, including those you do not use.

Unlike Mint, Simplifi is not free, costing users $35.99 per year, however it is noticeably cheaper than YNAB, so might make a good alternative if you are short on money and are looking for a more simplified budgeting app.

A standout feature of this app is their custom watchlists, which allow you to limit spending by category or payee. You can use their tools to see your total income and expenses every month. You will not be able to create specific goals, you can add a budget, compare monthly spending habits, and categorize your spending. The custom spending plan monitors your cash flow to make sure you never spend more than you make, which is super helpful.

|

|

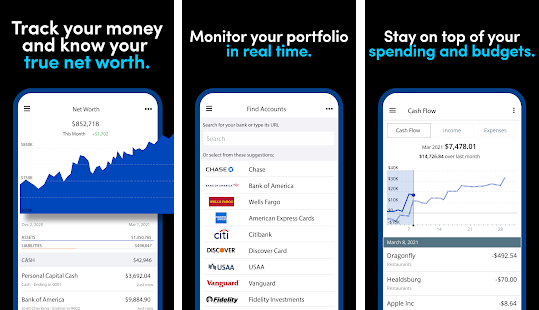

Personal Capital – Track Your Money

This app has some of the best tools for building your wealth. You sync your financial accounts in one place, and you can track your net worth, make future plans with the Retirement Planner, and use the Fee Analyser to check investment portfolio fees.

While it’s not necessarily for budgeting your day to day living, it is super useful if you are thinking about the future and wanting to build up your investments wisely.

|

|

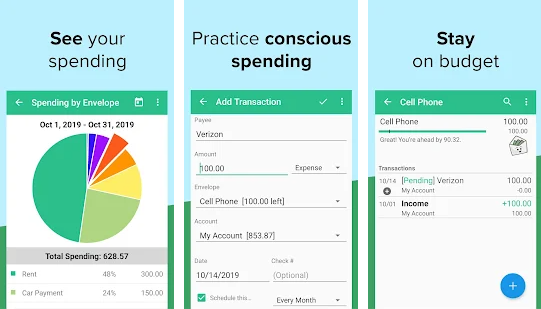

Goodbudget – Best Budget Planner

This app is based on the envelope system, in which you portion out your monthly income toward specific spending categories. One excellent feature is that this app allows multiple devices to access the same account, so partners and family members can share a budget.

This app doesn’t allow you to sync your bank accounts, you have to manually input your bank accounts and any cash amounts and debts. Once you enter this information, then you start splitting your money into spending categories, known as envelopes.

|

|

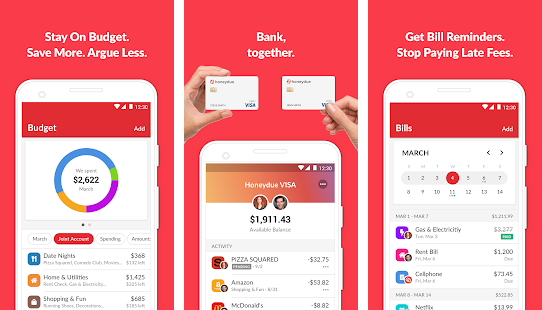

Honeydue – Couples Finance

If you and your partner share finances and need a shared budget app, then Honeydue is a great choice. You and your partner can see both financial pictures in one spot, including bank accounts, credit cards, loans and investments. You do retain the ability to choose how much financial information you share with your partner.

This free budgeting app automatically categorizes expenses, but you can also set up custom categories. Together, you can set up monthly spending limits on your chosen categories and the app will alert you when you or your partner are coming close to the limit. There is even a chat function.

|

|

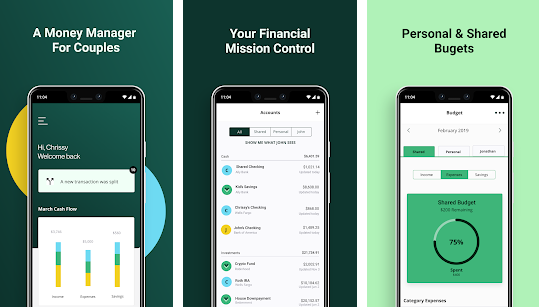

Zeta – Finest Money Manager

Another excellent app for couples to use, as it was specifically designed for this purpose. The app caters to a wide variety of couples, from living together, to new parents and allows you to sync various accounts. Once this is done, it will track spending, allow you to see your net worth and manage your bills together.

Not only does this app allow you to create a shared budget together, but it also lets you both make your own personal budgets as well. Zeta also has Zeta’s Money Date Mag, an online publication covering love and money in today’s world, which includes articles that expand your financial knowledge.

You can also sign up for a joint no-fee banking account and cards with several features like early access to direct deposit and access to the MoneyPass ATM network.

|

|

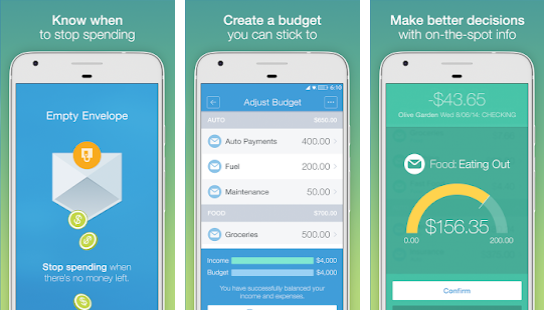

EveryDollar – Track Spending & Saving

This is one of the best free budgeting app that helps you track your spending and plan for purchases, which is great if you struggle with calculating whether you will have enough to pay all your bills and afford to make that purchase. As will YNAB, it is tailored for zero-based budgeting.

With the free version, you manually enter a transaction each time you spend money to account for it in your budget. Or pay for Ramsey+ membership, for all things finance, which offers the premium version of EveryDollar.

The upgraded version allows you to connect your bank accounts, along with access to financial advice content and other great tools. Ramsey+ costs $129.99 per year after a 14-day free trial.

|

|

Mvelopes – Top Budgeting App

Lastly, there is Mvelopes, a money envelope budgeting app that is a good alternative to GoodBudget. Just like GoodBudget, you put your money into envelopes by category. Mvelopes though allows you to sync with your bank accounts, making the process more automatic and easier to manage. You can make unlimited envelopes and track spending by type of expense. Not only that but this app also tracks credit cards, debit cards, and online bill payments.

It’s not free however, a basic plan is $6/month up to the Plus plan which is $19/month but offers quarterly coaching sessions, personalized money plans, and priority chat and phone support.

|

|

Having a budget is a necessary part of managing your finances well. These ten apps are the best budgeting and personal finance apps. They offer the best variety, great features, and help people save.

Emily Henry is a writer at Student Writing Services and Best Essay Writing Services. She is passionate about educating her readers on their rights and helps them find representation. Emily is also an editor at Writing Populist.