Marriage is a major life event that in most cases sees the merging of hearts and finances. This can be a concern for business owners as the wide ranging effects of a divorce on their business assets and partnerships can be devastating. However business owners can protect their business interests through pre-marital agreement options like a prenuptial agreements.

Understanding Prenuptial Agreements

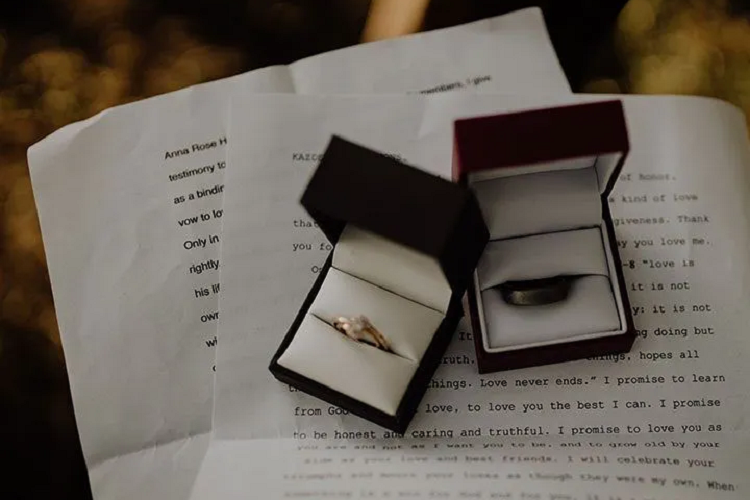

Prenuptial agreements, usually referred to in short as Prenups are legally binding contracts that a couple has drawn up before they marry which outline how assets and responsibilities will be divided after a divorce. Originally they were only popular among the wealthy, however these days they are considered wise decisions for business owners.

Business Ownership and Divorce

The process of divorce can be emotionally complex, which is made more complicated with the inclusion of business ownership. In the absence of a prenuptial agreement, business assets can be divided up, making the business’s sustainability and future uncertain.

In some instances, the courts may even force the sale of a business to aid in division of assets which can be detrimental to the business and its partnerships.

Why Business Owners Need Prenuptial Agreements

Business owners have several reasons to consider prenuptial agreements:

- Asset Protection: Prenups can clearly define which assets are separate property (owned before the marriage) and which are marital assets (property acquired during the marriage). This reduces the risk of business assets or even the business as a whole being considered marital property.

- Preserving Business Control: Prenuptial agreements can have provisions that business control remains solely with the business owner. This prevents an ex-spouse from interfering with business operations.

- Protecting Business Partnerships: prenups can outline the terms in which business partners and stakeholders are protected in the case of divorce. A prenup in this case can help prevent unwanted disruptions to the business.

Components of a Business Oriented Prenup

To effectively protect business assets in a prenuptial agreement, certain key components should be included:

- Asset Inventory: a comprehensive list of all business assets and intellectual property should be included.

- Valuation Methodology: Define a clear valuation method that outlines the way the assets of the business will be appraised in the case of divorce.

- Ownership Provisions: Categorize assets that are seen as separate property and which are marital property.

- Spousal Support: Outline any financial provisions for the spouse in the event of divorce.

Valuation and Appraisal of Assets

The valuation and appraisal of business assets have to be accurate if a pre-nuptial agreement is to be drafted. The financial implications of a divorce are affected by these values.

Consult financial experts to ensure you receive the best appraisal which will be reasonable and in tune. This also minimizes the possibility of subsequent disputes.

Possible Tax Issues

Prudent business owners must exercise due diligence regarding the tax ramifications that are associated with the creation of a prenuptial agreement, particularly when it comes to substantial asset transfers.

To skillfully navigate this maze, it is recommended that you enlist the services of a tax expert or a lawyer, who can offer counsel to balance the need to legally minimize tax liabilities while adhering to the legal intricacies.

Consulting Legal and Financial Experts

A prenuptial agreement with business considerations cannot be one on your own. You are better off dealing with specialist family law attorneys as well as financial advisors. These professionals will be helpful in drafting an agreement that favors both your business and your marriage.

To Sum Up

Prenuptial agreements are strategic and proactive ways for business owners to protect their assets and partnerships in the event of divorce.

By taking time to create a well structured prenup that covers business ownership, valuations and potential tax implications, business owners can rest easy knowing the future of their business is secure.

It is important to consult with both legal and financial advisors in this process, to ensure the business is protected within the confines of the law, in the best possible way.