Peer-to-peer lending is where one can contribute money without using a conventional monetary institution. This sort of loan is done online, and the interest rates are often cheaper than those found through a bank. Keep reading to learn more about peer-to-peer lending and how it can benefit you.

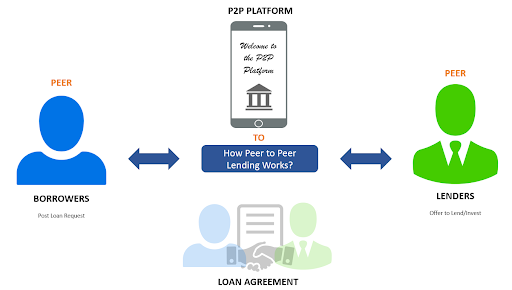

Peer-to-peer (P2P) lending functions as a web-based virtual commercial centre that connects money lenders with borrowers in need of assets. This Fintech development is significantly altering how commercial credit centres work. The financial backers get better gamble changed returns while borrowers get speedy credit on low-loan costs. Because it is a stage where two parties connect, you can sign up as either a loan specialist or a borrower.

What is Peer-to-peer lending?

Thanks to the transformed peer lending banking system, investments are more profitable thanks to available credit. They provide services at lower costs than other traditional bank loan programs and pass it on to borrowers in the form of lower and decent interest rates. This type of lending can offer a number of advantages, including lower interest rates and more flexible repayment terms.

Borrowers are looking for an individual credit register on the web. The phase of P2P lending uses information and innovation to research the borrower’s creditworthiness. After a credit check, you will be assigned a gambling class and loan cost. Creditworthy borrowers will get the advance in the least conceivable time.

In the event that you register as a financial backer/loan specialist, your record will be opened at the lending stage. You can start putting resources into buyer credits from as little as 15,000. You have an influence on the selection of the deposit you want to contribute to. You can build your portfolio by choosing credits from different gambling classes.

When the borrower begins paying the loan fees they will get the profits as EMIs (head and interest). P2P lending offers expansion beating returns a few rates higher than a bank account or fixed stores. You can either pull out or reinvest to partake in the intensifying advantages.

How does it work?

Peer-to-peer lending is a form of lending in which individuals, rather than banks or other financial institutions, lend money to each other.

Peer-to-peer lending platforms typically use risk-based pricing, which means that the interest rates on loans are based on the borrower’s creditworthiness. This means that borrowers with good credit can get lower interest rates, while borrowers with bad credit will have to pay higher rates.

Loans provided through peer-to-peer lending platforms are often unsecured, meaning they are not secured by collateral. However, because the loans are unsecured, they are also riskier for both borrowers and lenders.

What makes P2P lending exceptional?

Online application process

Borrowing money online is an instant method to earn capital as private credits. It is completely unique to the usual bank and credit union pre-approval cycle; where you should apply physically by filling the extended structures and visiting the banks to check your provisional status. In P2P lending, the entire advanced application process is on the web. To apply as a borrower, you simply need to connect to the site. When you transfer all the basic documentation, your down payment will be supported by relying on your credit repayment record and qualifications.

Simpler advance endorsement

Banks and credit associations check your credit qualification exclusively based on your record of loan repayment (CIBIL score). Online cash loan specialists use optional data to evaluate your creditworthiness, including your education, monthly salary, loan-to-salary ratio, and other relevant monetary thresholds.

No guarantee required

P2P lending offers unsecured individual credits. In this way, in the event that you neglect to reimburse an unstable credit, then you will surely confront the lawful ward yet there is no gamble of losing your property.

Better rates

Lenders charge low loan fees unlike institutional moneylenders like banks. With P2P lending stages, you can appreciate lower rates with apparent assistance fees (if any). P2P lending organizations do not have to keep up with a similar amount as the bank account, and this means that they do not face comparable administrative costs. In the end, you get the lowest financial costs for your own deposit.

Advantages and disadvantages of peer-to-peer lending

Peer-to-peer lending is a type of lending that allows individuals to borrow and lend money from one another without going through a financial institution.

This type of lending can be done through an online platform or through personal relationships. The advantages of peer-to-peer lending include the ability to get a loan with bad credit, the ability to get a loan without collateral, and the ability to get a loan with a lower interest rate. The disadvantages of peer-to-peer lending include the risk of default and the lack of regulatory oversight.

Conclusion

Peer-to-peer lending is a great way to get the money you need without having to go through a bank. It is important to remember that you are still borrowing money and will need to repay the loan with interest. Peer to peer lending software can be a great option for those who need a loan and don’t want to go through a bank.

Hermit Chawla is an MD at AIS Technolabs PVT LTD which is a Web design and Development Company, helping global businesses to grow by Web Development offshore Company. I would love to share thoughts on Social Media Marketing Services and Game Design Development etc.